Recognizing the Relevance of Insurance coverage and Why You Have to Have It

Insurance policy, often viewed as a grudging necessity, basically serves as an important bulwark versus financial tragedy. Picking the appropriate insurance policy is not uncomplicated, affected by myriad aspects that call for mindful factor to consider.

The Function of Insurance Coverage in Taking Care Of Threat

Key Sorts Of Insurance Policy Policies and Their Advantages

To browse the complex landscape of threat management, comprehending the vital kinds of insurance plan and their corresponding advantages is crucial. Medical insurance, as an example, covers medical costs, mitigating the economic problem of ailment and a hospital stay. Life insurance offers monetary safety and security to beneficiaries in the occasion of the insurance policy holder's fatality, making certain financial security throughout difficult times. Building insurance safeguards against damages to or loss of property as a result of events like fire or theft, guarding one's financial investments.

Automobile insurance policy is compulsory in several areas and covers responsibilities and damages in automobile crashes, promoting road security by allowing drivers to cover the prices of prospective accidents. Obligation insurance policy shields people and companies from financial loss occurring from legal obligations, thus protecting individual or company properties versus cases and lawsuits. Each kind of insurance acts as a tactical tool for taking care of certain dangers, making them indispensable in professional and personal balls.

Exactly How Insurance Coverage Sustains Financial Stability and Development

In addition, the accessibility of insurance reinforces financial development by advertising risk-taking and investment. When they have insurance to cover possible risks, companies and business owners are much more likely to spend in new ventures or broaden existing ones. This vibrant not only assists in developing more jobs but additionally boosts economic activities throughout numerous sectors. Therefore, insurance policy is pivotal not just for specific protection but likewise for the wider financial more info here landscape.

The Refine of Selecting the Right Insurance Coverage Insurance Coverage

Picking the appropriate insurance policy protection can usually appear discouraging. The procedure calls for mindful analysis of individual or service requirements, together with a clear understanding of what different policies offer. It is important to start by identifying the threats that looks for to reduce. Whether it concerns health, life, obligation, or home, recognizing the prospective hazards helps in picking the proper range of coverage.

Following, comparing numerous insurance policy suppliers is important. This involves examining their reputation, protection terms, premium costs, and client service records. Making use of on the internet contrast tools can enhance this step, supplying a side-by-side sight of options.

In addition, their website talking to an insurance policy broker or financial consultant can give insights tailored to details circumstances. These experts can debunk complex terms, aiding to ensure that the selected insurance coverage properly satisfies the person's or business's requirements without unneeded prices. abilene tx insurance agency. Hence, thoughtful analysis and professional recommendations are type in choosing the best insurance coverage

Usual Misconceptions Regarding Insurance Coverage Disproved

While selecting the right insurance coverage is a precise process, there prevail false impressions concerning insurance that can hinder informed decisions. One common myth is that younger individuals don't need insurance, particularly health or life insurance. However, unexpected events can happen at any type of age, making very early insurance coverage sensible. Another false impression is that insurance policy is excessively costly. In reality, numerous options are customized to different spending plans, with differing degrees of navigate to this website coverage and deductibles.

There is the erroneous belief that all insurance coverage plans are basically the same. Understanding these truths is critical for making well-informed insurance decisions.

Conclusion

To conclude, insurance coverage plays an essential duty in managing threat and promoting monetary security. By recognizing and spending in the ideal insurance coverage individuals, businesses and policies can shield themselves versus potential losses, therefore making it possible for financial development and individual protection. Selecting the ideal protection is vital, and unmasking typical mistaken beliefs regarding insurance coverage can result in more enlightened choices, guaranteeing that one's financial future is well-protected versus unanticipated situations.

Molly Ringwald Then & Now!

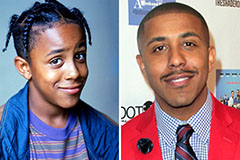

Molly Ringwald Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! David Faustino Then & Now!

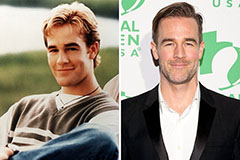

David Faustino Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!